Beyond Insurance: Build a Legacy That Lasts

Expert home and auto coverage for today, with a strategic blueprint for your family’s tomorrow.

Protection for Today. A Blueprint for Your Future

Whether you just need a quick auto quote or a full home policy, we ensure your coverage is more than just a piece of paper. We help you secure the best rates right now while making sure your foundation is ready for whatever comes next.

The Basics

Start with the home and auto coverage you need today at a price that makes sense.

The Paper Legacy

We look at your existing "one-off" policies to find the gaps and overlaps that cost you money.

The Blueprint

As your life scales, we bridge the gap into life and living benefits to protect your true legacy.

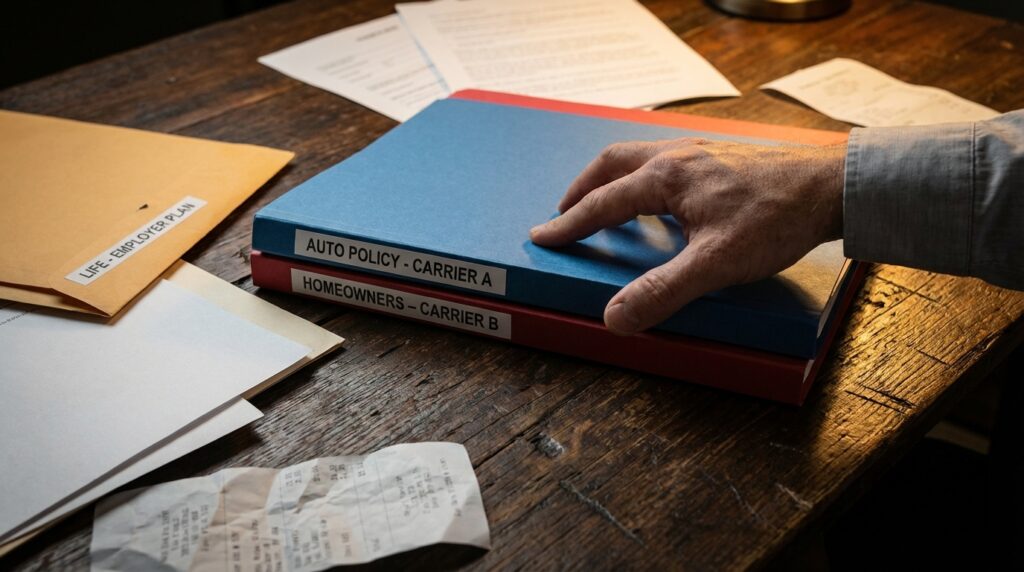

The Danger of a

"Paper Legacy"

Most people have a collection of disconnected policies—a home policy from one carrier, auto from another, and a default plan from an employer. This creates a Paper Legacy: a structure that looks secure on a screen but reveals critical gaps under the pressure of a real-world accident, illness, or lawsuit.

A “Paper Legacy” is a house built without a blueprint. As your career scales and your family grows, this fragmented foundation becomes your greatest liability. “Good enough” coverage is the most expensive mistake an achiever can make.

Most families are only 40% protected.

We secure the coverage you need today with your future in mind. We don’t push additional products when you simply want auto insurance, but we do build a roadmap so you can see a little further down the path.

The Milestones:

Level 1: Mobility & Property. Are your daily assets insulating your net worth or exposing it?

Level 2: Liability & Life. Is your “Fortress” built to withstand the unknown?

Level 3: Generational Wealth. Is your protection integrated with your estate and legacy goals?

How To Build A Legacy

Pillar 1: Audit Your Current Foundation

We start by identifying exactly where your current coverage leaves you exposed. We don't guess; we analyze your assets to find the seams in your protection.

Pillar 2: Design Your Protection Blueprint

Your first meeting is about design, not a sales pitch. We build a personalized roadmap that secures what you have today while planning for where you're going.

Pillar 3: Stress-Test for Constant Stability

Life moves fast. We conduct annual reviews to ensure your plan scales with your career, your family, and your growing net worth.

Pillar 4: Align Your Wealth and Vision

Building a legacy requires coordination. We work with your other advisors to ensure your insurance works in harmony with your estate and wealth goals.

Why Legacy Group?

Comparative Analysis: Strategic Certainty

| Strategic Framework | The "Paper Legacy" (Standard) | The Legacy Blueprint |

|---|---|---|

| Asset Foundation | Fragmented; policies are gathered in isolation over time as unrelated, reactive chores. | Holistic; architected as a single, interlocked protection system from day one. |

| Risk Methodology | Transactional; purchasing based primarily on premium price and "good enough" limits. | Strategic; stress-testing total liability against your evolving personal net worth. |

| Plan Evolution | Static; "set it and forget it" coverage that fails to scale as your career and assets grow. | Dynamic; disciplined annual reviews that recalibrate the blueprint for future growth. |

| Client Outcome | Illusion of safety; high risk of asset erosion during a single high-impact liability event. | Strategic Certainty; a resilient, multi-generational fortress for your life's work. |

Common Questions

I just need car or home insurance today. Is Legacy Group right for me?

Absolutely. We meet you exactly where you are in your journey, whether that is securing your first home or protecting a growing estate. While we always build with your “Future Self” in mind, our primary goal is to ensure your current “Momentum” is protected with the right coverage at the right price.

What is the difference between a 'Paper Legacy' and a 'Legacy Blueprint'?

A “Paper Legacy” is a collection of disconnected policies gathered over time that may have hidden gaps. A “Legacy Blueprint” is a single, interlocked protection system where every policy—auto, home, and life—is architected to work together to eliminate those gaps.

Will I be pressured to buy financial products I don’t want?

No. Our process is a “Blueprint Session,” not a sales call. We identify the 40% of protection that most professionals are missing and show you the roadmap to fix it, but you decide the pace of that journey. At the end of the day we are humans who need insurance too. We treat people how we wanted to be treated.

Are you more expensive than the big-name insurance carriers?

Because we are independent agents, we aren’t tied to a single company. We shop multiple A-rated carriers to find the best fit for your current needs and your future goals. We often find that clients were previously overpaying for “standard” plans that left them with critical gaps in their protection. Our goal is to provide significantly more coverage and “Strategic Certainty” at a value that actually fits your budget.

How often do we review my plan?

Static defense is a failing defense. We conduct disciplined annual reviews to ensure your protection scales in lockstep with your career, your family, and your evolving net worth.

Stop Collecting Policies.

Start Building Your Legacy.

Don’t let a fragmented foundation put your life’s work at risk. Architect a protection strategy built for the long term.